FOR STOCK VALUATION

WHY USE THE POTENTIAL PAYBACK PERIOD (PPP)

INSTEAD OF THE PRICE EARNINGS RATIO (PER)

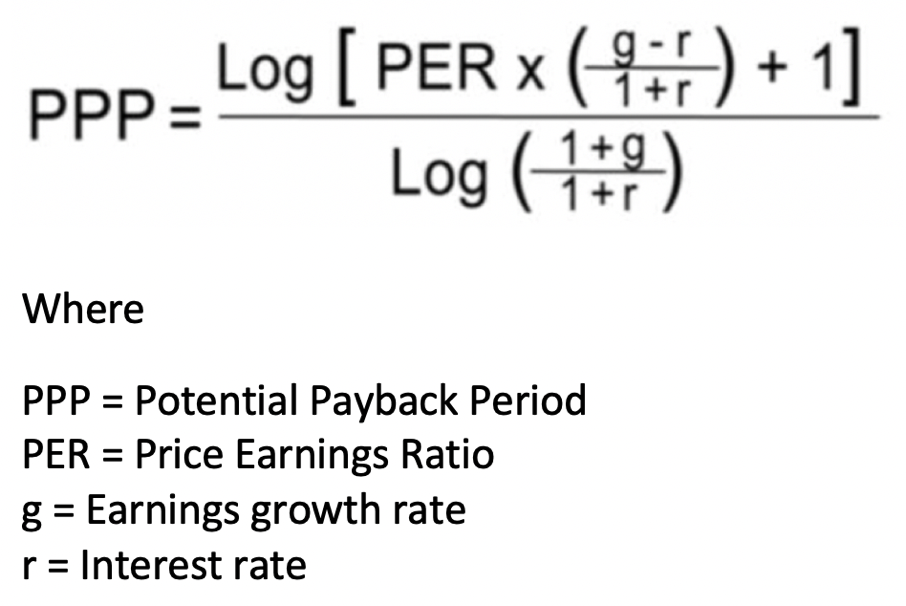

The Potential Payback Period (PPP) is defined as the period of time

necessary to equalize the current stock price with the sum of future

earnings per share. Therefore it is a mathematical adjustment of the

traditional P/E ratio (PER) to earnings growth rates, thus allowing more

meaningful stock comparisons.

Future earnings are discounted to their present value using a long-term

interest rate as the discount rate, thus taking into account interest

rates in stock valuation.

For more details go to https://stockinternalrateofreturn.com/index.html