INSTANT CALCULATION OF A STOCK'S POTENTIAL PAYBACK PERIOD (PPP)

AND INTERNAL RATE OF RETURN (IRR)

EVEN IF EARNINGS PER SHARE (EPS) ARE NEGATIVE (LOSSES) OR CLOSE TO ZERO

(0)

AND PRICE-EARNINGS RATIOS (PERs) THEREFORE NOT SIGNIFICANT

EPS < 0 or EPS ≃ 0

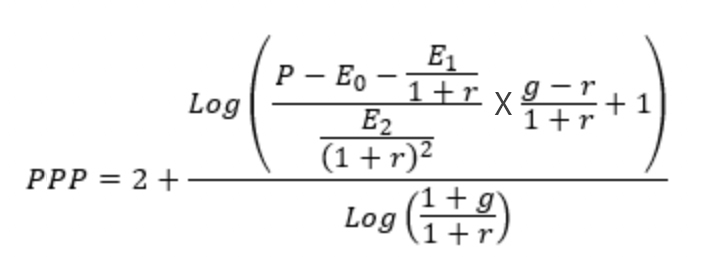

PPP = Potential Payback Period

P = Share price today

E0 = EPS for the current year (year 0)

E1 = EPS for next year (year 1)

E2 = EPS for the following year (year 2)

g = EPS growth rate (in %) starting year 2

r = Interest rate (in %) today

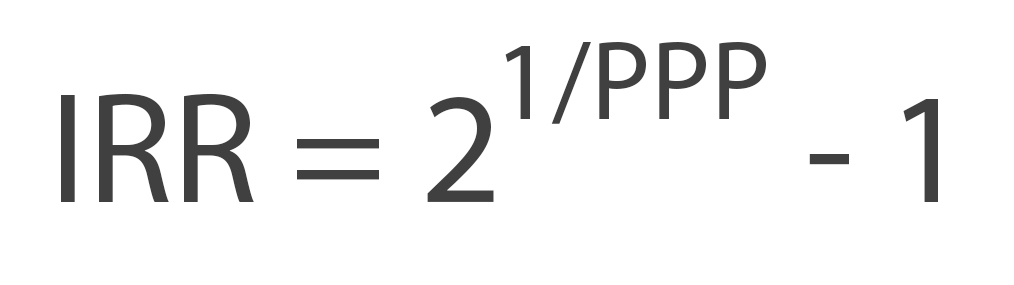

IRR = Internal Rate of Return

PPP = Potential Payback Period

INSTANT CALCULATIONS FOR SIMULATIONS ON A PARTICULAR STOCK

OR FOR EVALUATION AND COMPARISON OF SEVERAL

DIFFERENT STOCKS

| Stocks | P | E0 | E1 | E2 | g | r | PPP | IRR |

|---|---|---|---|---|---|---|---|---|

| Example 1 | 100 | 10 | 10 | 10 | 0 % | 0.0001 % | 10.00 | 7.18 % |

| Example 2 | 100 | 0 | 0 | 10 | 0 % | 0.0001 % | 12.00 | 5.95 % |

| Example 3 | 100 | -10 | -10 | 10 | 0 % | 0.0001 % | 14.00 | 5.08 % |

| A | % | % | - | -% | ||||

| B | % | % | - | -% | ||||

| C | % | % | - | -% | ||||

| D | % | % | - | -% | ||||

| E | % | % | - | -% | ||||

| F | % | % | - | -% |

P = Share price today

E0 = EPS for the current year (year 0)

E1 = EPS for next year (year 1)

E2 = EPS for the following year (year 2)

g = EPS growth rate (in %) starting year 2

r = Interest rate (in %) today

PPP = Potential Payback Period

IRR = Internal Rate of Return