HOW TO EVALUATE STOCKS WHEN THE P/E RATIO BECOMES IRRELEVANT

IN THE CASES OF STARTUPS AND TURNAROUND SITUATIONS

(When EPS < 0 or

EPS ≃ 0)

INTRODUCING THE POTENTIAL PAYBACK PERIOD (PPP)

For an instant calculation of the PPP of any stocks go to

www.stockinternalrateofreturn.com/instant_calculations.html

Investors sometimes need to evaluate companies for which the P/E ratio

(price-to-earnings ratio) is meaningless, at least temporarily. This is

particularly the case with startups or companies in turnaround

situations.

In a common scenario, these companies often report losses for the

current year (referred to as "year 0"), followed by results close to

zero for the next year (referred to as "year 1"), and then a more

"normal" profit in the following year (referred to as "year 2"). It is

from this "year 2" that the company will enter a steady growth phase

characterized by more or less regular profit growth.

In such an example, the company’s P/E ratios for year 0 and year 1

cannot be meaningfully calculated, and therefore, the company in

question cannot be compared with other companies in the same sector that

have well-defined P/E ratios.

This is where the concept of "payback period" (PP) or "potential payback

period" (PPP) proves to be useful (see

“Analyse

Financière,”

the review of the French Society of Financial Analysts, 3rd quarter of

1985).

Unlike the P/E ratio, which measures the value or "expensiveness" of a

stock for a single year, the PPP does so over a much longer period.

Initially, the two concepts are quite similar. For example, a P/E ratio

of 10 means it takes 10 years of earnings per share to equalize or

potentially "recover" the current stock price. But we assume here that

there is no profit growth or inflation over the years. In this case, the

P/E ratio is a kind of potential payback period (PPP) in a static world,

and it is also expressed in years like any other "period."

In reality, the PPP only adjusts the P/E ratio by introducing a profit

growth rate and an interest rate used to discount future profits. This

discount rate reflects inflation but also an opportunity cost, as the

investor who buys a stock forgoes the return they would get from a

long-term bond with much lower risks.

In other words, while the P/E ratio is a snapshot of a stock value based

on earnings for a single year, the PPP is a video that captures the

evolution of these earnings over a more or less extended period, which

is defined as the "period" required for the present value of future

earnings to equal the current stock price.

The PPP is, in fact, a measure of a company's earnings capacity, knowing

that this anticipated earnings capacity over the medium and long term is

what truly determines the value of the stock in the market.

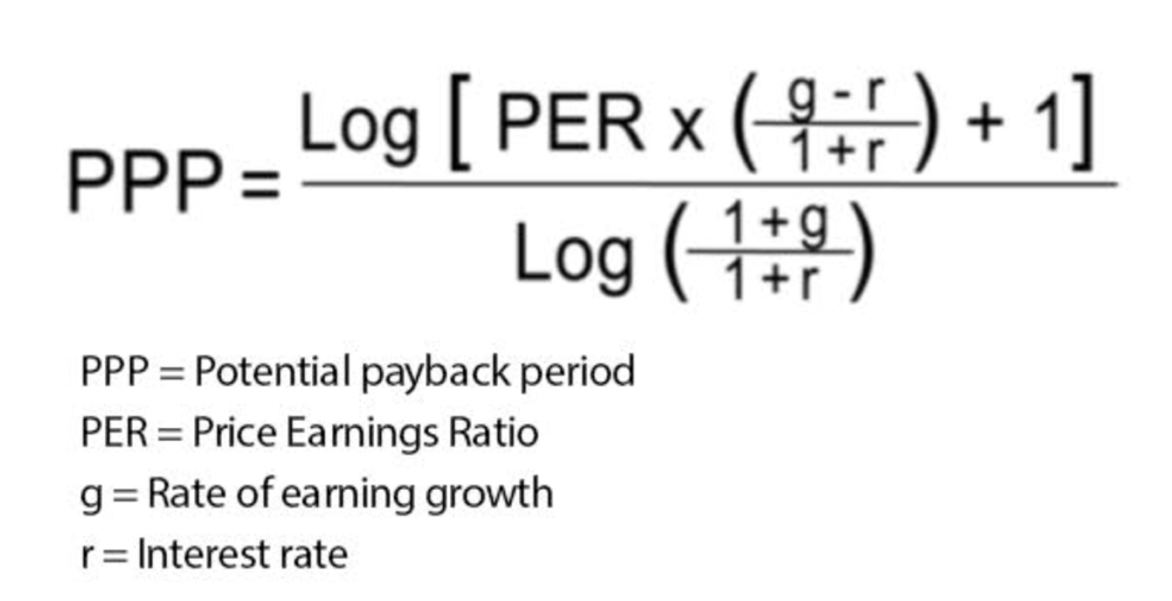

The PPP is calculated using the following formula:

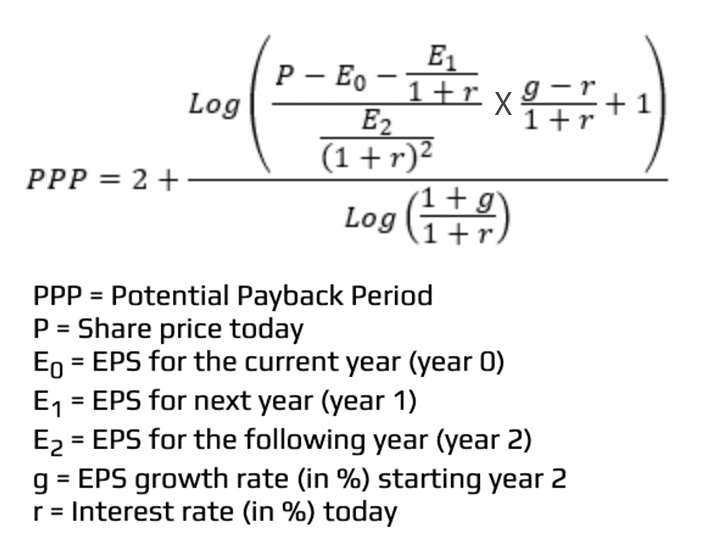

In the case of special situations like startups or companies in

turnaround situations as mentioned earlier, we can adapt the general PPP

formula above by directly introducing the loss for year 0, the near-zero

result for year 1, and the "normal" profit for year 2, from which we

apply a constant profit growth rate.

The adapted formula is as follows:

Let's take the example of a company A for which the P/E ratio is not

meaningful with the following data: P = 100, E0 = -10, E1 = 0, E2 = +10,

g = 8, r = 3.

Instant calculations can be performed

here

The result is: PPP = 11.47.

This PPP of 11.47 is quite significant as a "period" expressed in years,

and it can be meaningfully compared with the PPP of any other company,

regardless of its P/E ratio, whether that P/E ratio is meaningful or

not.

Now, consider the case of a company B that resembles company A in some

ways -- first with an identical share price of 100 -- but with a more

regular earnings growth. Its earnings per share start at 10 in year 0

and increase steadily by 8% per year. With a P/E ratio of 10 from the

start (100/10) and the same interest of 3%, applying the basic PPP

formula indicated at the beginning of this text yields: PPP = 8.35.

In any case, company A's PPP of 11.47 can be directly compared to

company B's PPP of 8.35, while no comparison is possible based on the

P/E ratio.

The PPP is used in the same way as the P/E ratio. All else being equal,

the attractiveness of a stock is inversely proportional to its PPP.

Thus, in the example above, company B with a PPP of 8.35 is more

attractive or less "expensive" than company A with a PPP of 11.47.

In summary, relying solely on the P/E ratio to assess the value or

"expensiveness" of stocks can lead to absurd results. Indeed, the P/E

ratio can reach astronomical levels when earnings per share for the

chosen year are close to zero, and it loses all meaning in the case of

losses for the considered year. In contrast, the PPP can be meaningfully

calculated for any stock at any time, even for startups or companies in

turnaround situations involving temporary losses.