India has overtaken China in terms of economic growth, signaling a major shift in global economics. This

transition, anticipated by many analysts, is now being amplified by stock markets, illustrating not only an

economic realignment but also far-reaching geopolitical consequences. As the world’s two most populous

countries, each with approximately 1.4 billion inhabitants, China and India are not just Asia’s strongest

economies but also political rivals with contrasting government models. China, the sole communist

superpower, and India, the world’s largest democracy, represent two opposing ideologies and governance

models. The outcome of their economic rivalry is set to profoundly impact global geopolitics.

1. Real GDP Growth Rates: China vs. India

The first graph depicts the real GDP growth rates of China and India from 2020 to 2024, showing a marked

divergence between these two economic giants.

• China’s Economic Path (Red Line):

○ China experienced a strong post-pandemic rebound in 2021, with GDP growth peaking at

around 8%. However, in subsequent years, growth slowed to about 4% by 2023 and 2024. The red dashed trend

line shows a clear deceleration, reflecting deeper structural issues such as an aging population, high debt

levels, and the impact of regulatory tightening.

• India’s Economic Path (Green Line):

○ India, after a sharp contraction in 2020 due to the pandemic, rebounded robustly in 2021

with growth rates exceeding 8%. Although growth tapered off slightly in 2022, India’s economy stabilized

around 6% by 2024. The green dashed trend line indicates an upward trajectory, highlighting India’s

long-term economic momentum fueled by its youthful demographic, technological advancements, and growing

domestic consumption.

Key Observations:

• Rivalry for Growth Leadership: China and India have long been at the forefront of global

economic growth, but India has now overtaken China in terms of growth rate. This economic rivalry reflects

their broader geopolitical contest, with each country vying for influence in Asia and beyond.

• Contrasting Growth Trends: While China’s growth is slowing, India’s economy is on a

steady upward trend, showcasing its resilience and growing prominence on the world stage.

2. Stock Market Performance: Shanghai Stock Exchange vs. Bombay Stock Exchange

The second graph compares the performance of the Shanghai Stock Exchange (SSE) and the Bombay Stock Exchange

(BSE) from 2020 to 2024. The divergence in their stock market trajectories mirrors their economic growth

patterns.

• Shanghai Stock Exchange (SSE) Performance (Red Line):

○ The SSE saw moderate growth in 2021, reflecting China’s brief economic recovery after the

pandemic. However, from 2022 onward, the SSE’s performance declined steadily, dipping below its 2020

baseline by 2024. This reflects a combination of economic deceleration, regulatory crackdowns, and investor

wariness about China’s growing internal challenges, such as its real estate crisis and rising debt.

• Bombay Stock Exchange (BSE) Performance (Green Line):

○ In contrast, the BSE showed consistent growth, rising sharply after 2021 and reaching an

index value close to 150 by 2024. India’s stock market performance highlights global investor confidence in

the country’s economic prospects, driven by its reform agenda, demographic dividend, and burgeoning digital

economy.

Key Observations:

• Market Sentiment Shifts: The growing gap between the SSE and BSE reflects a significant

shift in global capital flows. Investors, once heavily focused on China, are now turning to India as a new

growth hub, attracted by its democratic stability, reform-driven growth, and a more predictable regulatory

environment.

• Stock Markets as a Reflection of Governance Models: The divergence in stock market

performance also mirrors the fundamental differences in governance between China and India. China’s

centralized, state-controlled system has introduced unpredictability for foreign investors, particularly due

to regulatory crackdowns. India’s democratic system, while not without challenges, offers more transparent

and market-friendly policies, enhancing investor confidence.

3. Geopolitical Implications: A Contest Between Two Ideologies

The economic and stock market divergence between China and India is not just an economic story—it represents

a broader ideological contest between two very different models of governance. China, the only communist

superpower, and India, the world’s largest democracy, are engaged in a strategic and economic rivalry that

will shape the future of global geopolitics.

• Two Competing Models: China’s authoritarian system emphasizes centralized control and

rapid state-led development, while India’s democracy fosters a more decentralized, market-driven approach.

The outcome of this rivalry will have significant implications for how countries around the world view these

contrasting systems, especially in developing regions that may look to emulate one of these models for their

own growth.

• Geopolitical Rivalry: Both countries are competing for influence, not only in Asia but

also globally. India’s rise as an economic power strengthens its geopolitical position, particularly within

the Quad alliance (comprising the U.S., Japan, Australia, and India) and other global forums. India’s

growing economic clout provides an important counterbalance to China’s dominance, both within Asia and on

the global stage.

4. Challenges and Risks for India and China

Both nations face unique challenges that could affect their long-term growth trajectories:

• India’s Challenges:

○ Infrastructure Deficits: India must address significant infrastructure

gaps in transport, energy, and digital connectivity to maintain its growth trajectory.

○ Inequality and Job Creation: While India’s economy is growing rapidly,

ensuring that growth is inclusive remains a major challenge. The country must generate millions of jobs to

accommodate its large and youthful population.

• China’s Challenges:

○Demographic Decline: China’s aging population presents a long-term

challenge to its economic dynamism. With a shrinking workforce and rising healthcare costs, China may

struggle to maintain high growth rates in the coming decades.

○ Debt and Real Estate: China’s economic growth has been driven by heavy

investment in real estate and infrastructure, leading to high levels of debt. This reliance on debt-fueled

growth is now becoming a significant drag on the economy.

Conclusion

The graphs presented clearly illustrate a defining moment in global economic history—India has overtaken

China in terms of economic growth and stock market performance, signaling a major shift in global economic

power. As the world’s two most populous nations and Asia’s largest economies, the rivalry between these

countries extends far beyond economics. It is a contest between two opposing models of governance—India’s

democracy and China’s authoritarianism.

The geopolitical stakes of this rivalry are immense. As India continues to rise, its influence in global

economic and political forums will grow, potentially reshaping the balance of power in Asia and beyond.

Meanwhile, China’s economic slowdown and internal challenges could lead to a reevaluation of its

long-standing dominance. How these two nations navigate their respective challenges will determine not only

their future economic trajectories but also the future of global governance.

In this contest between two superpowers with opposing ideologies, the world will closely watch to see which

model emerges as the most effective in fostering sustainable and inclusive growth. The outcome of this

rivalry will reverberate far beyond the borders of China and India, shaping the future of global economic

and geopolitical landscapes for decades to come.

Rainsy Sam

12 septembre 2024

BRAZIL / BRÉSIL

Variation de l’indice sur

- 5 ans : + 30 %

- 3 ans : + 21 %

- 1 an : + 15 %

Valorisation

- Indice au 6 septembre 2024 : 134.572,45

- PER : 10,16 (Source: Bloomberg)

- Taux de croissance des bénéfices : + 14 % (Source: Simply Wall Street)

- Taux d’intérêt : 11,83%

- Délai de Recouvrement Potentiel (DRP) ou Potential Payback Period (PPP) : 9,36

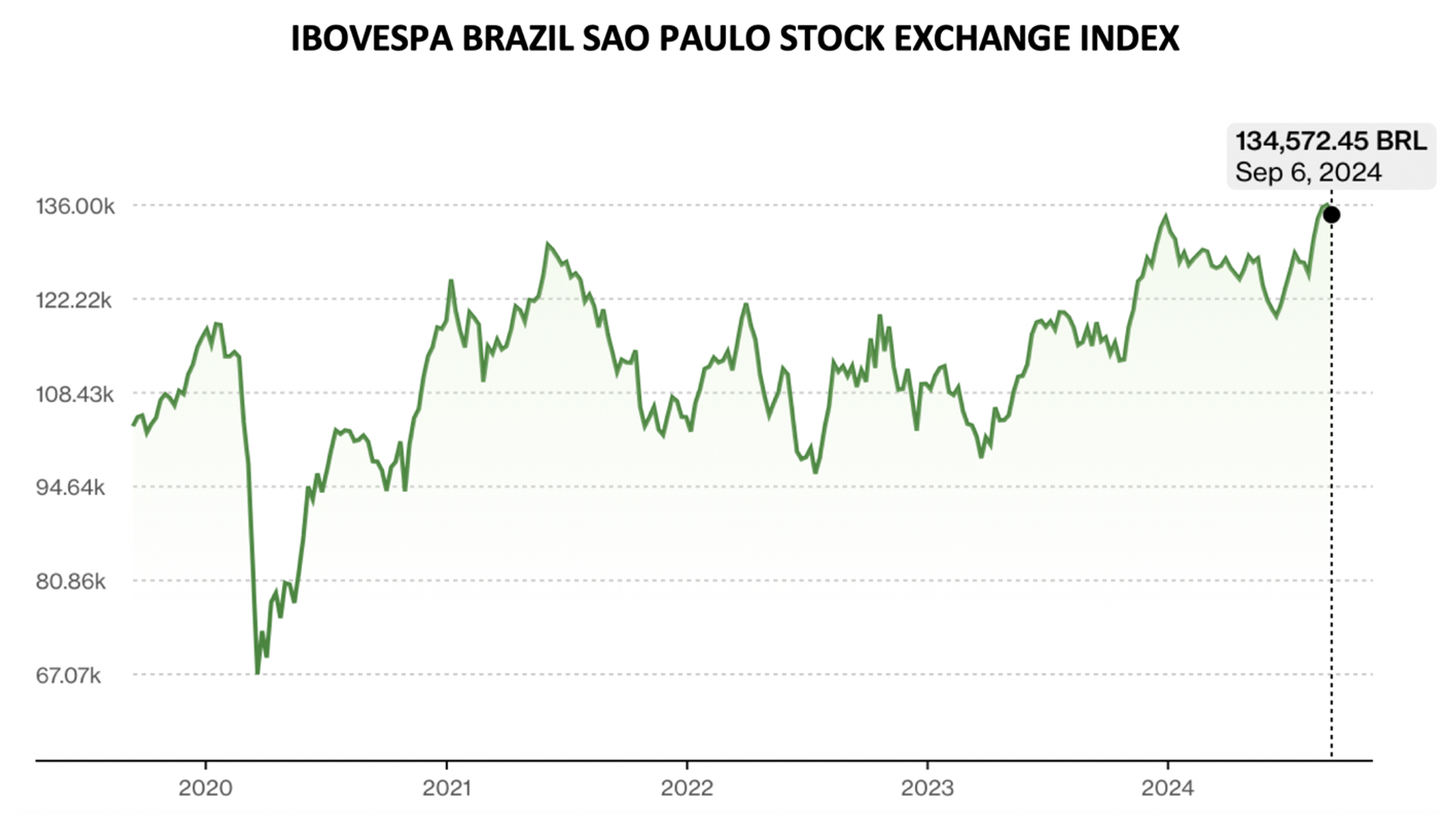

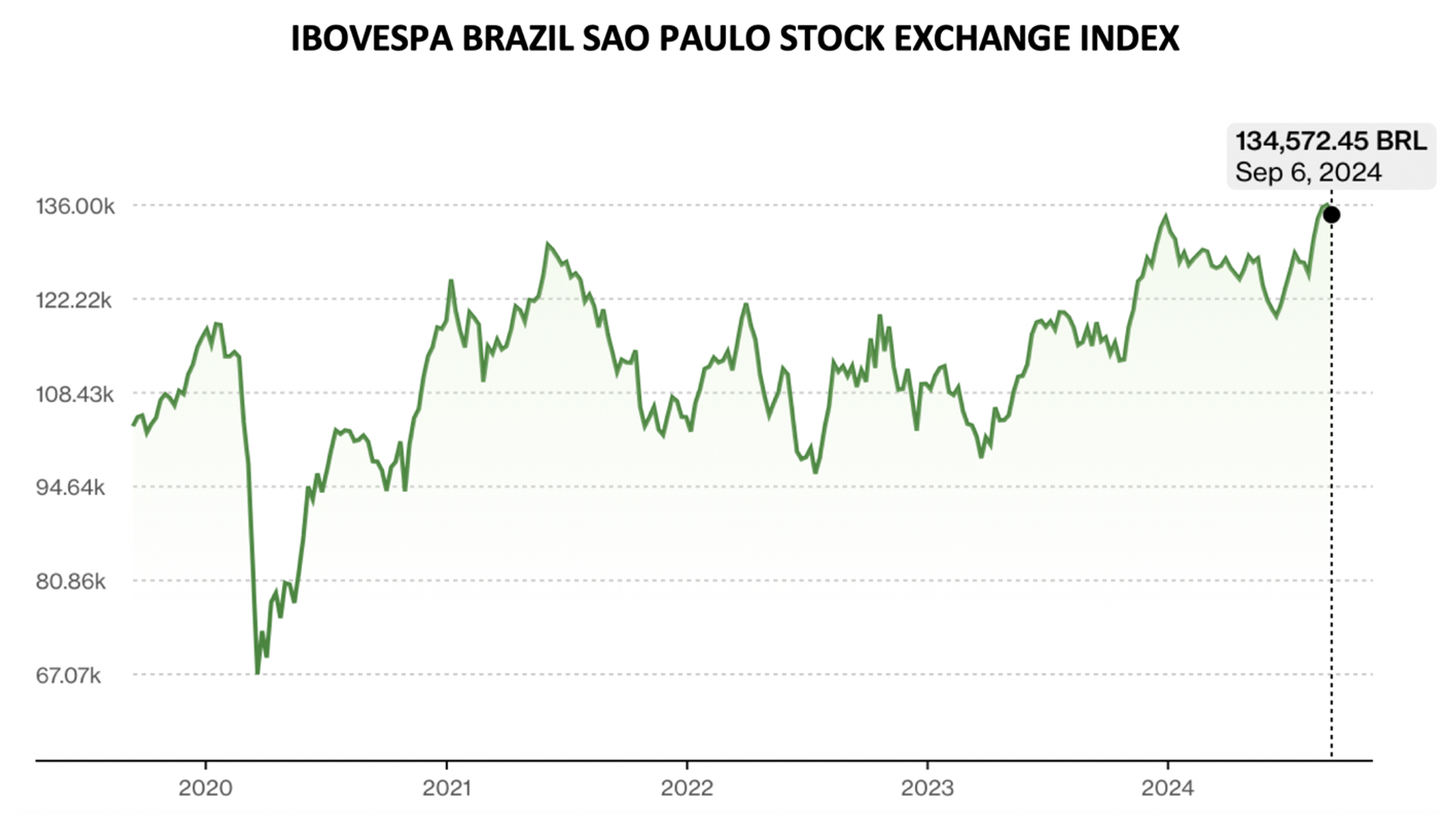

I- EVOLUTION RECENTE DE LA BOURSE BRESILIENNE

Sur les cinq dernières années la Bourse du Brésil (indice Bovespa) a connu une évolution heurtée mais sa

tendance reste haussière. Voici les principales phases de cette évolution.

2020 : Effondrement du marché dû à la pandémie de COVID-19

On observe une chute abrupte de la Bourse en 2020, correspondant à l'impact économique mondial causé par la

pandémie de COVID-19. Le Brésil a été l’un des pays les plus durement affectés par cette pandémie. Les

marchés financiers du monde entier ont été touchés par des confinements, la baisse de la demande globale et

l'incertitude économique.

2021 : Reprise rapide

Après la chute, l'indice a connu une reprise rapide. Cela peut s'expliquer par la mise en place de mesures

de relance économique par les gouvernements, l'accélération de la vaccination et le retour progressif des

activités économiques.

2022-2023 : Périodes de volatilité

La période entre 2022 et 2023 montre plusieurs fluctuations importantes, probablement liées à des facteurs

économiques locaux (comme des incertitudes politiques au Brésil), mais aussi à des dynamiques mondiales

telles que les perturbations des chaînes d'approvisionnement, l'inflation, et les hausses de taux d'intérêt

par les grandes banques centrales pour lutter contre cette inflation.

2024 : Phase de stabilisation et de croissance

L'indice semble avoir atteint des sommets à partir de 2024, signalant une période de stabilisation

économique au Brésil. Cela pourrait indiquer une amélioration des fondamentaux économiques du pays, un

contrôle de l'inflation et une reprise plus robuste des secteurs industriels et financiers. Le marché semble

avoir retrouvé une certaine confiance des investisseurs.

II- PERSPECTIVES ECONOMIQUES ET FINANCIERES FAVORABLES

Les perspectives bénéficiaires des entreprises brésiliennes pour les prochaines années apparaissent

favorables pour plusieurs raisons, liées à des dynamiques internes et externes positives. Ces perspectives

devraient avoir un impact significatif sur la Bourse brésilienne, attirant potentiellement des investisseurs

à long terme et favorisant la hausse des indices boursiers.

1. Croissance économique soutenue

• Le Brésil, en tant que plus grande économie d'Amérique latine, connaît une reprise économique

progressive

après les chocs liés à la pandémie de COVID-19 et à la volatilité mondiale. Le retour à la

croissance du PIB

et la stabilisation des secteurs clés, tels que l'agriculture, l'énergie et les matières premières,

devraient alimenter la hausse des bénéfices des entreprises.

• En outre, le gouvernement brésilien a mis en œuvre des réformes structurelles

pour favoriser

les investissements étrangers, améliorer la productivité, et stimuler l'innovation. Ces réformes, couplées à

une demande intérieure croissante, offrent des bases solides pour une croissance

bénéficiaire soutenue.

2. Prix élevés des matières premières

• Le Brésil est un grand exportateur de matières premières, notamment le

pétrole, le fer, le

soja, et d'autres produits agricoles. La demande mondiale pour ces matières premières reste

élevée, en

particulier en provenance de la Chine et d'autres économies émergentes.

• Les prix mondiaux des matières premières demeurent relativement élevés, ce

qui contribue à

améliorer la rentabilité des entreprises exportatrices brésiliennes. Ces entreprises sont bien positionnées

pour tirer parti des tendances globales, et l'augmentation de leurs bénéfices pourrait avoir un impact

positif sur la Bourse brésilienne.

3. Rôle stratégique dans la transition énergétique

• Le Brésil a un rôle central à jouer dans la transition énergétique mondiale. Le pays est un

leader en matière de production d'énergie renouvelable, notamment grâce à

l'hydroélectricité et au

biocarburant (éthanol). Cette position privilégiée lui permet d'attirer des capitaux dans

le secteur de

l'énergie verte.

• De nombreuses entreprises brésiliennes du secteur énergétique développent des

technologies de

décarbonation et participent activement aux initiatives de développement durable. Cette

transition vers une

économie plus verte pourrait se traduire par des gains de bénéfices pour ces entreprises, qui bénéficieront

également d'une demande accrue pour des solutions énergétiques durables.

4. Réduction des taux d'inflation

• L'inflation au Brésil, bien qu'élevée en 2022-2023, a montré des signes de

ralentissement. La

baisse de l'inflation contribue à stabiliser l'économie et améliore les marges bénéficiaires des entreprises

locales en réduisant les coûts des intrants.

• Avec une politique monétaire plus stable, la Banque centrale du Brésil

pourrait même envisager

de réduire les taux d'intérêt, ce qui allégerait encore le coût du capital pour les

entreprises. Cela

permettrait aux entreprises brésiliennes de financer plus facilement leurs activités et d'augmenter leurs

investissements, stimulant ainsi leur capacité à générer des bénéfices plus élevés dans les années à venir.

5. Accès accru aux marchés financiers et investissements étrangers

• Le climat des affaires au Brésil s'améliore, avec une meilleure intégration dans les marchés

financiers mondiaux et une attractivité croissante pour les investissements étrangers

directs. De nombreux

fonds d'investissement internationaux cherchent à capitaliser sur le potentiel de croissance des entreprises

brésiliennes.

• Cette affluence de capitaux étrangers, couplée à une meilleure liquidité du marché,

permettrait à de nombreuses entreprises brésiliennes de lever des fonds pour financer leur expansion et

augmenter leurs bénéfices à moyen et long terme.

6. Diversification industrielle et innovation technologique

• Le Brésil diversifie de plus en plus son économie, en encourageant des secteurs tels que la

technologie, le commerce électronique, et les services financiers

numériques. Des entreprises brésiliennes

innovantes émergent dans ces secteurs et connaissent une forte croissance de leurs revenus.

• L'expansion de l'économie numérique brésilienne, ainsi que la digitalisation accrue des

services et des industries, est de bon augure pour la croissance bénéficiaire de ces entreprises. La

transformation numérique au Brésil devrait entraîner des gains de productivité, renforcer

la compétitivité

des entreprises locales et soutenir les bénéfices à long terme.

Impact possible sur la Bourse brésilienne (Indice Bovespa)

• Augmentation des valorisations : Une croissance bénéficiaire soutenue des

entreprises brésiliennes, combinée à des perspectives économiques positives, devrait naturellement se

traduire par une augmentation des valorisations boursières. Les actions des entreprises

cotées sur le

Bovespa pourraient bénéficier de multiples de capitalisation plus élevés, reflétant la confiance accrue des

investisseurs.

• Afflux d'investissements internationaux : Le Brésil étant perçu comme un

marché émergent attractif, une augmentation des bénéfices pourrait attirer un afflux de capitaux

étrangers,

renforçant encore les indices boursiers. Les investisseurs internationaux sont à la recherche de rendements

plus élevés dans des marchés en croissance, et la Bourse brésilienne pourrait bénéficier de cette dynamique.

• Réduction de la volatilité : Bien que les marchés brésiliens aient

historiquement été marqués par une volatilité relativement élevée, les perspectives bénéficiaires positives

pourraient contribuer à réduire l'incertitude et stabiliser les fluctuations du marché. Une

plus grande

prévisibilité des bénéfices inciterait les investisseurs à maintenir leurs positions à long terme, ce qui

contribuerait à la stabilité du marché.

• Expansion des secteurs porteurs : Les secteurs tels que l'énergie

renouvelable, la technologie et les matières premières continueront probablement de dominer la croissance

boursière. Ces secteurs, qui bénéficient de tendances globales de long terme, attireront une

attention

accrue des investisseurs et pourraient entraîner des hausses significatives dans les indices

boursiers.

Conclusion

Les perspectives bénéficiaires favorables des entreprises brésiliennes sont soutenues par des fondamentaux

solides, notamment la croissance économique, la demande mondiale pour les matières premières, la transition

énergétique, et l'innovation technologique. Ces facteurs devraient avoir un impact positif sur la

Bourse

brésilienne, contribuant à une hausse des valorisations, à une

stabilité accrue et à un afflux de capitaux

internationaux, tout en consolidant la position du Brésil en tant que marché émergent clé dans

le paysage

financier mondial.

Rainsy Sam

September 5, 2024

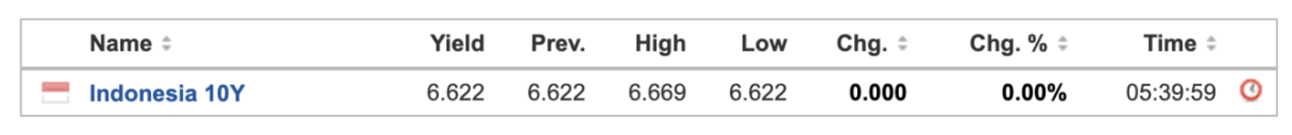

INDONESIA

P/E Ratio : 25.3

Earnings growth rate (g) : 19%

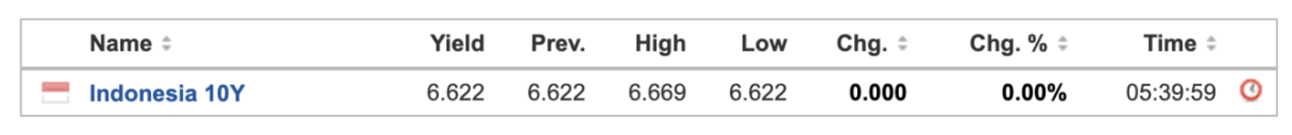

Discount rate (r) : 6.62%

Potential Payback Period (PPP) = 12.48

P/E Ratio : 25.3

Earnings growth rate (g) : 19%

Discount rate (r) : 6.62%

Potential Payback Period (PPP) = 12.48

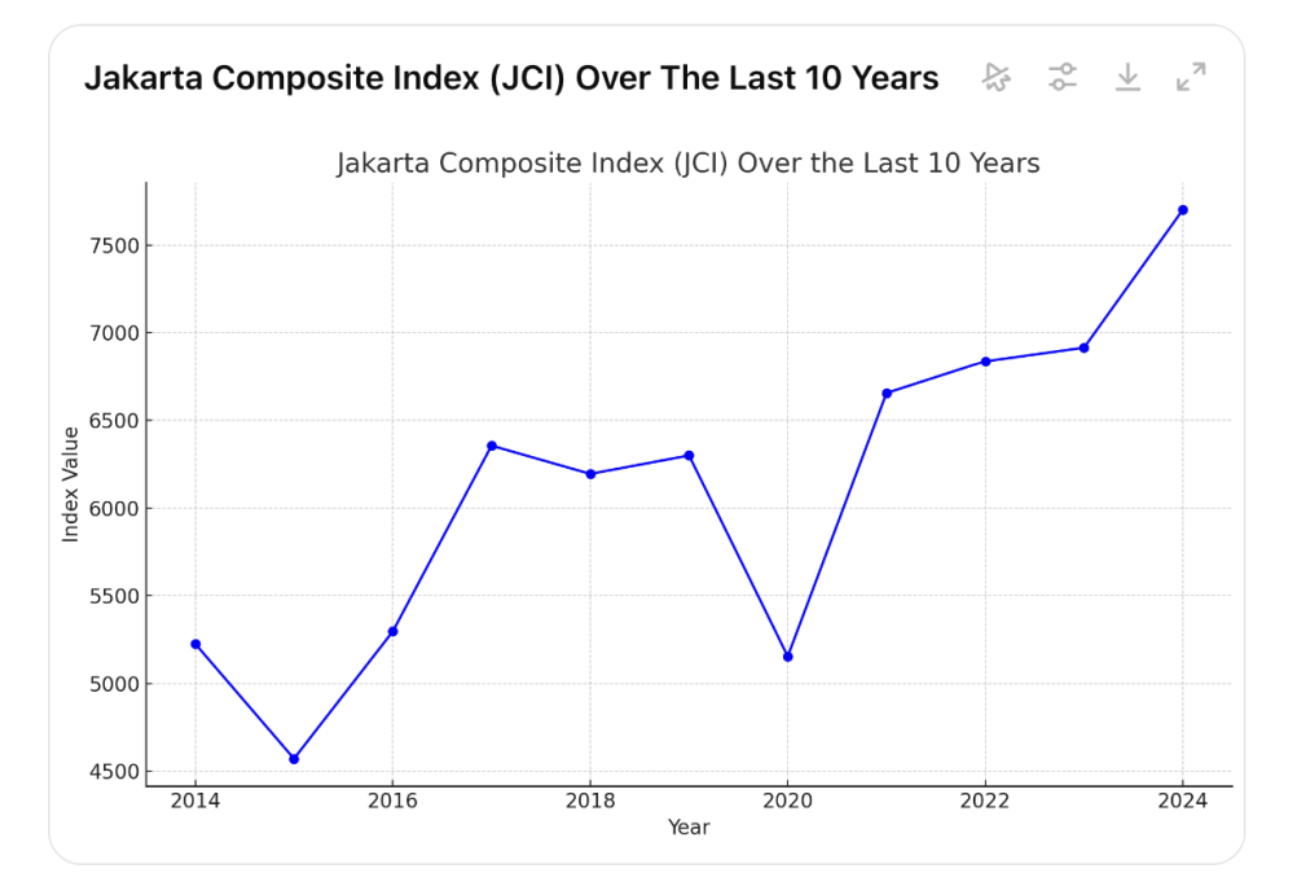

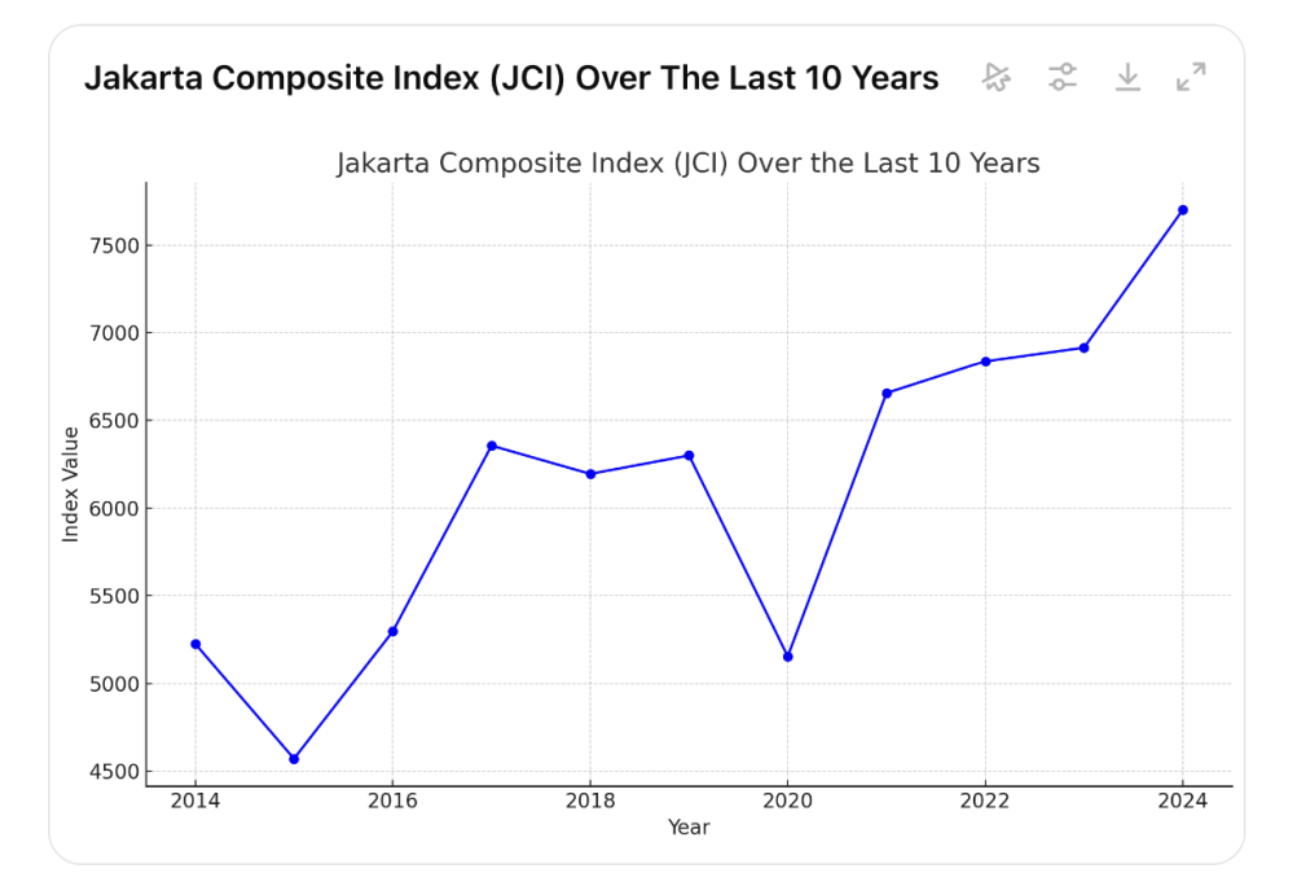

Key Factors Behind the Strong Performance of the Indonesian Stock Market Over the Past Decade, and Why This

Upward Trend is Poised to Continue

The Jakarta Stock Exchange (JCI) has performed well over the past 10 years due to several key factors:

1. Strong Economic Growth

Indonesia, the largest economy in Southeast Asia, has experienced consistent economic growth, averaging

around

5% annually. This steady growth, fueled by infrastructure development, rising domestic consumption, and

increasing foreign investment, has created a favorable environment for stock market performance.

2. Economic and Political Reforms

The Indonesian government has implemented various structural reforms aimed at improving the business climate

and

attracting foreign capital. These reforms include simplifying regulations, investing in infrastructure, and

removing barriers to foreign investment, which have bolstered investor confidence.

3. Sectoral Strength

Key sectors like natural resources, technology, and finance have played a significant role in the stock

market's

growth:

• Natural Resources: Indonesia is a major exporter of commodities such as palm

oil,

coal,

and minerals, and

global demand for these resources has positively impacted local businesses.

• Technology and Finance: The rapid growth of technology and financial

services,

including fintech startups,

has

attracted both local and foreign investors.

• Domestic Consumption: Indonesia’s expanding middle class has driven growth in

consumer goods and services

sectors, contributing to the strong performance of the stock market.

4. Foreign Investment

Indonesia has attracted consistent foreign direct investment (FDI) due to its long-term growth prospects.

International funds have been invested in infrastructure, renewable energy, financial services, and other

sectors, driving the market’s performance.

5. Monetary Policies

The Indonesian central bank has maintained accommodative monetary policies, including keeping interest rates

relatively low, which has supported domestic spending and investment. Low inflation rates have also

contributed

to a stable economic environment conducive to stock market growth.

6. Resilience during the COVID-19 Pandemic

Despite the initial downturn caused by the COVID-19 pandemic, the JCI rebounded quickly due to government

stimulus packages and a resilient domestic economy. Indonesia’s quick recovery helped restore investor

confidence and further boosted market performance.

7. Demographic Advantages

Indonesia’s young and growing population provides a solid foundation for future economic growth. The

increasing

consumer base supports domestic industries, including telecommunications, healthcare, and consumer goods,

which

contribute significantly to the stock market’s performance.

In conclusion, the combination of steady economic growth, sectoral strength, foreign investment,

favorable

monetary policies, and resilience during global crises has propelled the Jakarta Stock Exchange to

strong

performance over the last decade.

STOCK MARKET EVALUATION

The Indonesian stock exchange can appear attractive in terms of the Potential Payback Period

(PPP) when you

consider the following factors:

1. Price-to-Earnings (P/E) Ratio of 25.3

A P/E ratio of 25.3 means that investors are currently willing to pay 25.3 times the current earnings of the

companies in the index. While this may seem relatively high, the attractiveness in terms of the PPP depends

on the relationship between the P/E ratio and the expected growth rate.

2. Projected Earnings Growth of 19%

The projected annual earnings growth rate of 19% significantly boosts the PPP's attractiveness. When growth

is factored in, higher P/E ratios are often justified if earnings are expected to expand rapidly. Using the

PPP formula, the earnings growth rate helps shorten the theoretical recovery period for the investor, since

earnings are expected to compound at a fast rate.

In this case, a 19% annual growth rate implies strong future earnings potential, and the PPP formula would

reflect a quicker recovery of the investment, reducing the time it takes for earnings to potentially match

the initial investment (even though this is theoretical and based on the assumption that all earnings are

distributed).

3. Long-Term Risk-Free Interest Rate of 6.62%

The long-term risk-free interest rate in Indonesia (6.62%) serves as a discount rate in the PPP calculation.

Although this is a relatively high discount rate compared to more stable economies like the US, it reflects

the time value of money and the opportunity cost of investing in Indonesian stocks compared to risk-free

government bonds.

Despite this higher interest rate, the rapid earnings growth of 19% could offset the negative effects of a

higher discount rate, ensuring the PPP remains relatively short. The risk-adjusted return is still favorable

due to the robust growth outlook.

Why It Looks Attractive

• High Growth vs. High P/E: Although the P/E ratio of 25.3 might initially seem

high, the projected 19%

growth rate indicates that the company’s earnings are expected to grow rapidly, justifying the valuation.

The faster the earnings grow, the quicker the investment’s potential payback period shortens.

• PPP Formula Impact: The PPP formula adjusts for both growth and risk (through

the interest rate). Given

the significant projected growth, the PPP would show that investors might recover their investment much

faster than the P/E ratio alone suggests.

• Competitive Return Against Bonds: The long-term risk-free interest rate of

6.62% is quite high, but the

expected equity returns (with a 19% growth rate) would still likely outperform bond returns over the long

run, making the stock market relatively attractive despite the higher bond yields.

Conclusion

Given a P/E ratio of 25.3, a projected earnings growth of 19%, and a

long-term risk-free interest rate of

6.62%, the Indonesian stock market looks attractive in terms of the Potential Payback

Period

(PPP). The high

growth rate helps offset the elevated interest rate, making the time to recover the investment theoretically

shorter than a static P/E ratio might suggest.

P/E Ratio : 25.3

Earnings growth rate (g) : 19%

Discount rate (r) : 6.62%

Potential Payback Period (PPP) = 12.48

P/E Ratio : 25.3

Earnings growth rate (g) : 19%

Discount rate (r) : 6.62%

Potential Payback Period (PPP) = 12.48