EXPECTED EVOLUTION OF FINANCIAL MARKETS IN 2024

Market correction in the US / Continued bull market in Japan

To understand what can be expected from financial markets in 2024, we

must first try to see where they precisely stand at the end of 2023.

The following observations can be made from the table below.

As of December 28, 2023, the P/E Ratios (PER) for different markets are

very disparate, varying almost from simple to triple: 11.1 for the

United Kingdom and 29.0 for the USA.

Performance over the past year is also highly contrasting, ranging from

0% for the United Kingdom to 24% for the United States and Japan, and

even 26% for Taiwan.

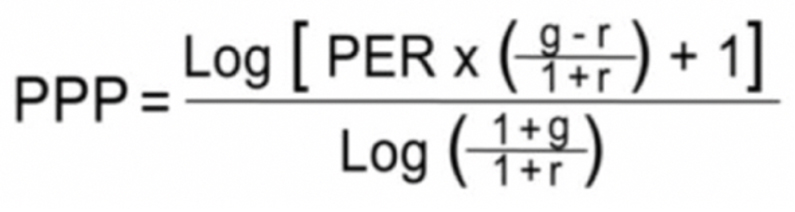

However, if we adjust the P/E Ratio to account for differentials in the

level of earnings growth rates and the level of interest rates –

according to the concept of the Potential Payback Period (PPP) – stock

markets then appear to be evaluated in a more homogenous manner, with

PPP varying in a much narrower range, less than from simple to double:

8.45 for the United Kingdom and 14.59 for France.

From the PPP of each market, we can directly calculate the Internal Rate

of Return (IRR) of that market. The IRR is the discount rate that must

be applied to future profits made over the period corresponding to the

PPP for these profits to equalize the current stock price.

Unlike the unadjusted P/E Ratio which can show disparate figures to the

point of becoming absurd, the IRR is always represented by meaningful

and realistic figures for all stocks on all markets. In our example the

figures stand between 4.87% and 8.55%. This shows markets’ rationality

when we use the right metrics.

The stock's IRR is to be compared with the yield of a long-term

risk-free bond, with the difference between the two rates being the risk

premium specific to each stock or stock market as a whole. The risk

premium may not be fully justified. At a given moment, it may be

considered too high or too low, leading to corrective movements.

The concept of PPP and IRR is explained in detail at

https://www.stockinternalrateofreturn.com/Genesis.html

As of 28 December 2023, the risk premium for the U.S. market is 1.26%.

This level is historically low. It seems excessively low compared to

that of other major markets like the Japanese market (6.24%).

With such a high risk premium, the Japanese market becomes relatively

very attractive.

Based on the fundamental elements we have just examined (PER, earnings

growth rate, and interest rate), we can suggest that the U.S. market has

very limited upside potential in 2024 and may even correct to raise the

risk premium.

On the other hand, with a relatively high risk premium of 6.24%, the

Japanese market should continue its rise in this new year.

With risk premiums of 6.09% and 6.24% respectively, the German and

Taiwanese markets also present promising appreciation prospects.

The reliability of these forecasts based on the concepts of PPP and IRR depends on the reliability and accuracy of the forecasted data entered into the model, particularly the projected earnings growth rate for the next 12 to 36 months. Any revision of earnings outlook in a stock market will lead to a re-evaluation of that market compared to other stock markets through a modification in the hierarchical ranking of the risk premium.

P/E Ratio = PER = Price Earnings

Ratio.

g = Projected earnings growth

rate for the next two or three years.

r = Long-term interest rate on a

risk-free bond (such as the 10-Year U.S. Treasury Note).

PPP = Potential Payback Period.

This is the time needed for the investment in the purchase of a stock to

be "potentially paid back" through future profits progressing at rate

"g" and discounted at rate "r".

IRR = Internal Rate of Return. This is the discount rate that must be applied to future profits made over the period corresponding to the PPP for these profits to equalize the current stock price. The IRR formula is directly derived from the PPP.

See mathematical demonstrations at

https://www.stockinternalrateofreturn.com/Mathematics.html

Source of data: The figures for P/E Ratio (excepted for France’s) and

projected earnings growth rates "g" come from Simply Wall St at

https://simplywall.st?via=rainsy

Rainsy Sam