ADVANTAGES OF THE POTENTIAL PAYBACK PERIOD (PPP)

AND INTERNAL RATE OF RETURN (IRR)

IN STOCK EVALUATION AND INVESTMENT MANAGEMENT

I- DEFINITIONS

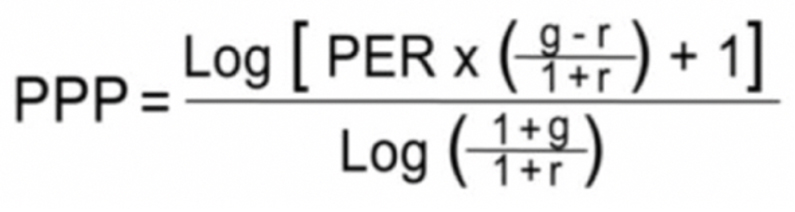

The Potential Payback Period (PPP) is a mathematical adjustment of the Price Earnings Ratio (PER) to incorporate earnings growth rate (“g”) and interest rate (“r”) in the stock evaluation process. It represents the time (in years) it takes for the buyer of a stock to "potentially recover" the stock purchase price through discounted future earnings.

Unlike the PER, which is a static measure as it captures the earnings of

a single year, the PPP dynamically measures – through the expected

earnings growth rate – the profit-making capacity (or earnings

potential) of a company over many years. This profit-making capacity of

a company determines the value of its stock.

Note: PER is a specific case of PPP. The PER indicates the number of

years of earnings needed to “recover” the stock price, assuming the

initial earnings remain constant over the years. On the other hand, the

PPP also indicates the number of years of profits needed to “recover”

the stock price but assumes a more general and realistic scenario where

future earnings will increase over the years. Additionally, PPP

replicates a more realistic environment by introducing an interest rate

to discount future earnings and compare them to the current stock

price.

The

Internal Rate of Return (IRR) is

the discount rate applied to future earnings over the PPP period to

equalize these earnings with the current stock price. IRR is thus a

derivative of PPP.

Demonstration of formulas at

https://www.stockinternalrateofreturn.com/Mathematics.html

II- ADVANTAGES OF PPP AND IRR

1- Rigorous adjustment of PER to take earnings growth rate into account

PPP, resulting from this adjustment, provides a more meaningful and

operational measure of stock "expensiveness." Stocks with seemingly

"prohibitive" PERs can become very attractive in terms of PPP,

especially when dealing with high-growth values.

There are empirical and approximate methods to adjust PER based on

earnings growth rate "g" such as the Price/Earnings-to-Growth Ratio

(PEG), which simply divides PER by "g" and favours stocks with a PEG

below 1. Through a slightly more complex formula, PPP moves from this

empirical and approximate approach to mathematical logic and precision.

The need to adjust PER is illustrated by the example of NVIDIA as we

wrote on 7 October 2023:

https://www.linkedin.com/feed/update/urn:li:activity:7116790087434035200/

2- Stock evaluation without PER

Since PPP apprehends a company's evolution over many (generally more

than 10) years, it remains meaningful and operational, whereas PER loses

its significance for a company experiencing temporary losses or making

profits close to zero for one or more years, as in the case of startups

or companies in a turnaround situation. PPP allows for meaningful

comparisons at any time between all companies, whether profitable or

making losses.

https://www.linkedin.com/feed/update/urn:li:activity:7144012724220436480/

3- Explanation and measurement of the impact of quarterly earnings revisions on stock prices

The value of a stock primarily reflects the profit-making capacity of a

company. The impact of quarterly earnings revisions on stock prices

actually reflects a reassessment of this profit-making capacity through

a revision of the earnings growth rate. Quarterly revision leads,

through extrapolation, to a revision of the earnings growth rate over a

period well beyond the quarter in question. A new earnings growth rate

immediately modifies the level of PPP, automatically resulting in an

adjustment of the stock price.

The stock market is highly sensitive to any change in the earnings

growth rate. It is not the growth rate itself (concept of "first

derivative" in physics) that matters most, but its acceleration or

deceleration (concept of "second derivative").

https://www.stockinternalrateofreturn.com/Earnings-Revisions.html

4- Refinement of stock selection models

As a synthetic and operational measure of stock value, PPP paves the way

for refining stock comparison and selection models. For example, a risk

factor can be introduced into such a model, establishing an inverse

correlation (entirely logical) between PPP and the risk factor. A

regression line can then be drawn, showing a quite understandable

decrease in PPP as risk increases. In other words, an investment must be

"recovered" more quickly as the environment becomes riskier. On the

other hand, IRR and risk vary in the same direction: higher

profitability is required with increasing risk.

https://www.stockinternalrateofreturn.com/Magnificent-Seven.html

5- Measurement of the impact of a change in interest rates on stock prices and establishment of a precise and novel link between stocks and bonds

The inverse relationship between interest rates and stock prices is

known intuitively and empirically. The PPP allows for the measurement of

the impact of a change in interest rates on the price of a stock.

The IRR, directly derived from PPP, measures the internal return of an

industrial or commercial operation that necessarily involves risk. This

return must be higher than that of a risk-free investment over an

equivalent period, namely a long-term government bond. The difference

between the IRR of a stock and the yield of a long-term government bond

represents the "risk premium" of that stock. This premium, which

practically ranges from 1 to 10%, varies inversely with the quality and

predictability of the company represented by the stock. In any case,

through the IRR of the stock, a precise and novel link is established

between the stock market and the bond market.

https://www.linkedin.com/feed/update/urn:li:activity:7134662603556950016/

6- Comparison of International Financial Markets

The scope of comparisons based on PPP can be extended to international

financial markets as a whole, which, in addition to differences in

average PERs, present differentials in the average earnings growth rate

and the interest rate on a risk-free long-term loan.

Starting from PPP, the IRR of each market is calculated. The difference

between the IRR and the risk-free long-term interest rate represents the

"risk premium," which is somewhat a safety margin for the investor. The

higher the "risk premium," the more attractive the market becomes. This

comparison of markets based on a synthetic indicator like the "risk

premium" can be an interesting tool for international capital

management.

https://www.linkedin.com/feed/update/urn:li:activity:7148362250381127681/

7- Rationality and Homogeneity of Financial Markets

PPP and IRR allow verifying the rationality and homogeneity of financial

markets. If one relies solely on PER to assess the "expensiveness" of

stocks, absurd orders of magnitude can be reached. Indeed, PER can reach

astronomical amounts when the earnings per share for the selected year

is close to 0, and it loses all meaning in the case of losses. On the

other hand, PPP and IRR, which integrate fundamental data over a longer

period, can be calculated significantly for any stock at any time, even

for companies in a turnaround situation involving temporary losses.

https://www.stockinternalrateofreturn.com/negative-earnings-per-share.html

In any case, PPP varies over a limited range of about 5 to 15 years,

corresponding to an IRR range of approximately 15 to 5% in the opposite

direction. These figures for PPP and IRR can be considered significant,

realistic, and credible due to their reasonable order of magnitude and

relative stability, demonstrating the rationality and homogeneity of

financial markets.

https://www.stockinternalrateofreturn.com/Genesis.html

Rainsy Sam

Investment manager

Former Cambodian Finance Minister