VALUATION OF THE "MAGNIFICENT SEVEN" U.S. TECH STOCKS

(Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla)

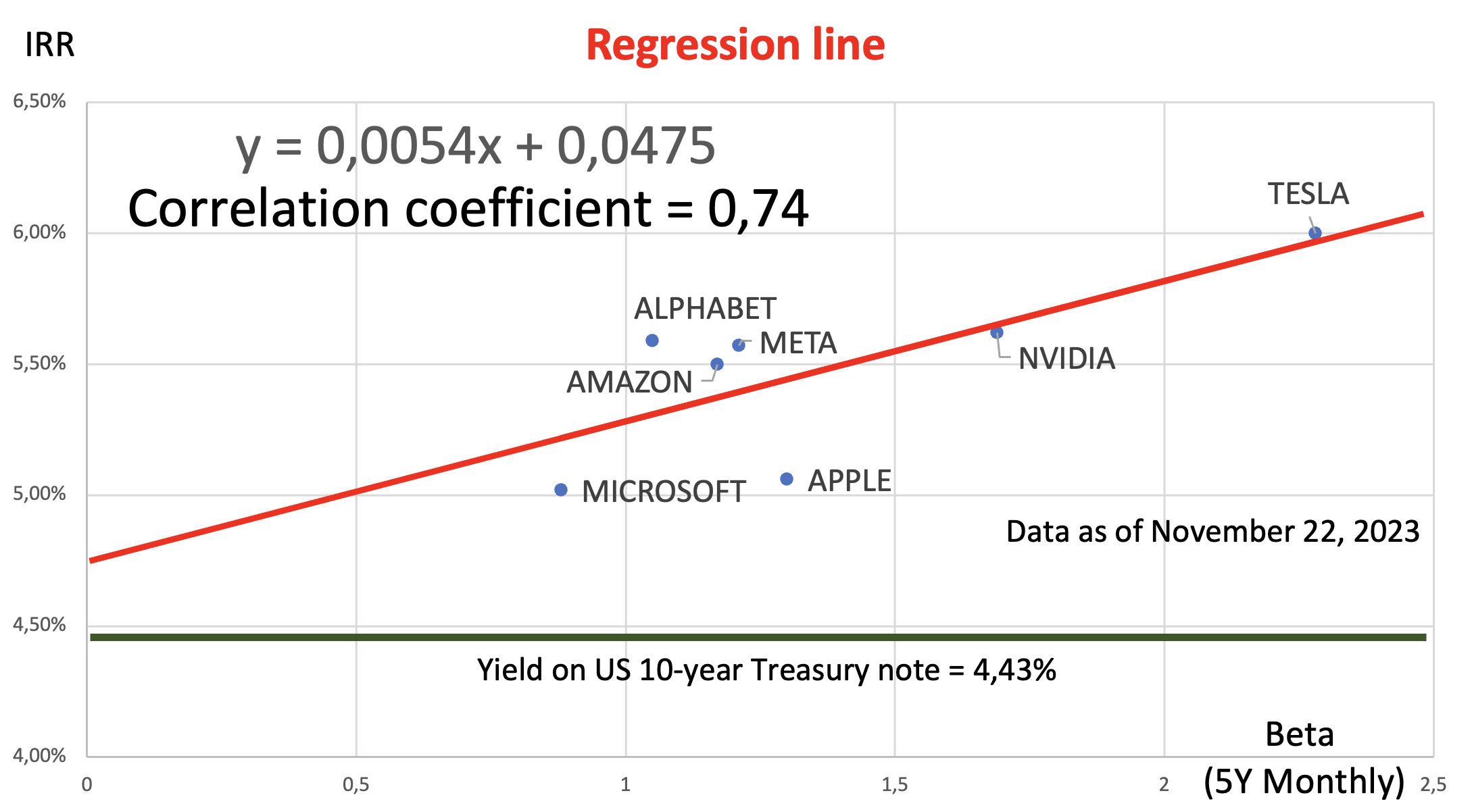

Regression line

Y-AXIS : Internal Rate of Return (IRR)

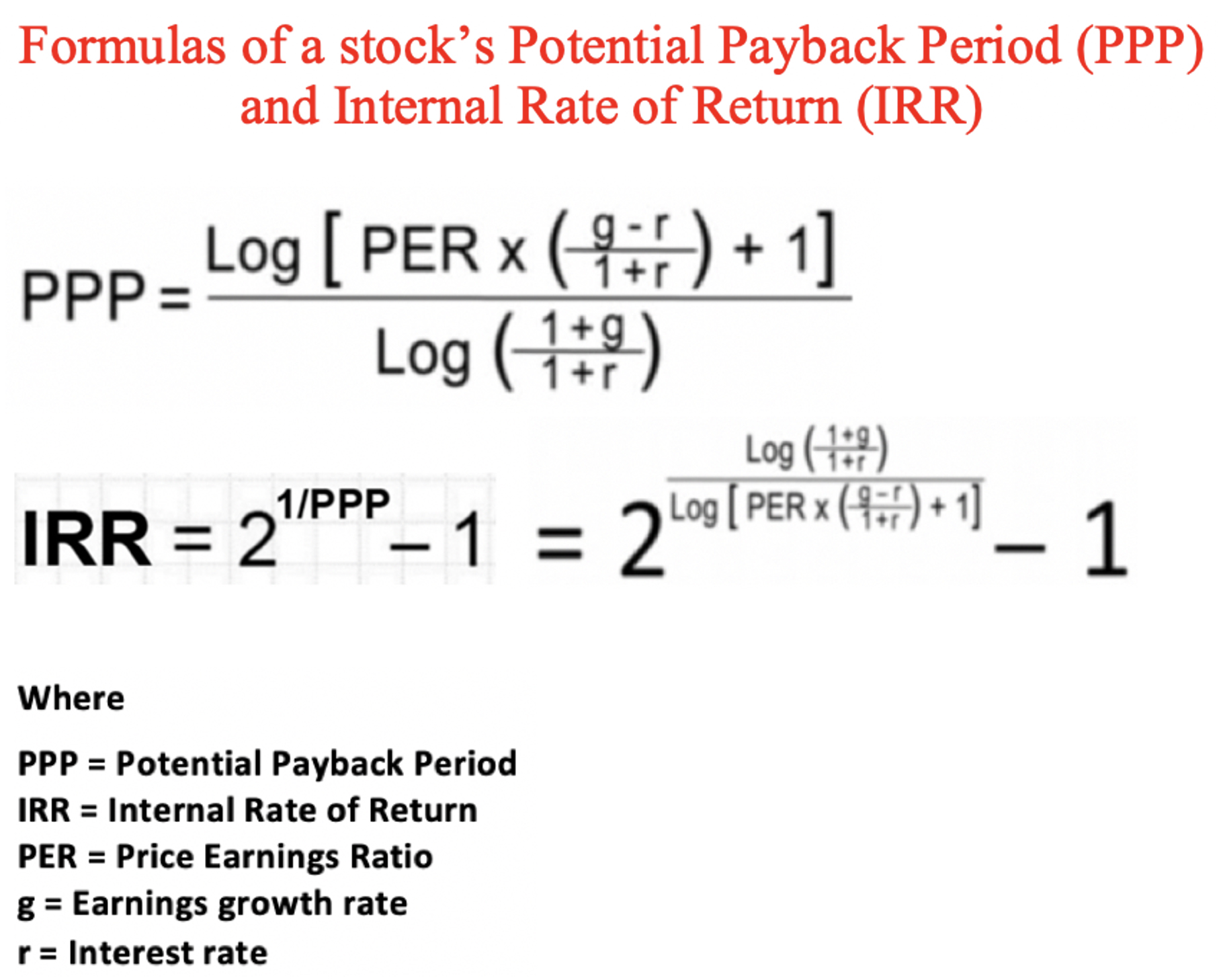

A stock’s internal rate of return (IRR) is directly derived from its

potential payback period (PPP). Defined as the period of time necessary

to equalize the current share price with the sum of future earnings per

share discounted to their present value, the PPP is basically a

mathematical adjustment of the price earnings ratio (PER) to earnings

growth rate. It measures a company’s profit-making capacity (or earnings

potential) which basically determines the value of the company’s stock.

The shorter the PPP the stronger the company’s profit-making capacity

and the more attractive its stock. The IRR is the discount rate which

allows the investor in a given share to potentially double their

investment through the cumulation of earnings per share over the period

corresponding to the PPP which has been calculated for the stock. The

higher the IRR the more attractive the stock. The IRR of a stock should

normally be higher than the yield of a risk-free long-term bond (such as

the 10-year U.S. Treasury bond in our example), with the difference

between the two rates representing the risk premium that characterizes

each stock.

See

https://stockinternalrateofreturn.com/

X-AXIS : Beta

The Beta is a measure of the risk associated with a company (a

coefficient of share price volatility in our example).

Interpretation

- Companies practically on the regression line (Nvidia, Tesla) are correctly valued.

- Companies above the regression line (Alphabet, Amazon, Meta) are undervalued.

- Companies below the regression line (Microsoft, Apple) are overvalued.

Data as of November 22, 2023.

Any inflection in earnings growth rates, as indicated by revisions in

quarterly earnings estimates, must be closely monitored as it

immediately impacts the PPP and the IRR.

Demonstration at https://www.stockinternalrateofreturn.com/Mathematics.html